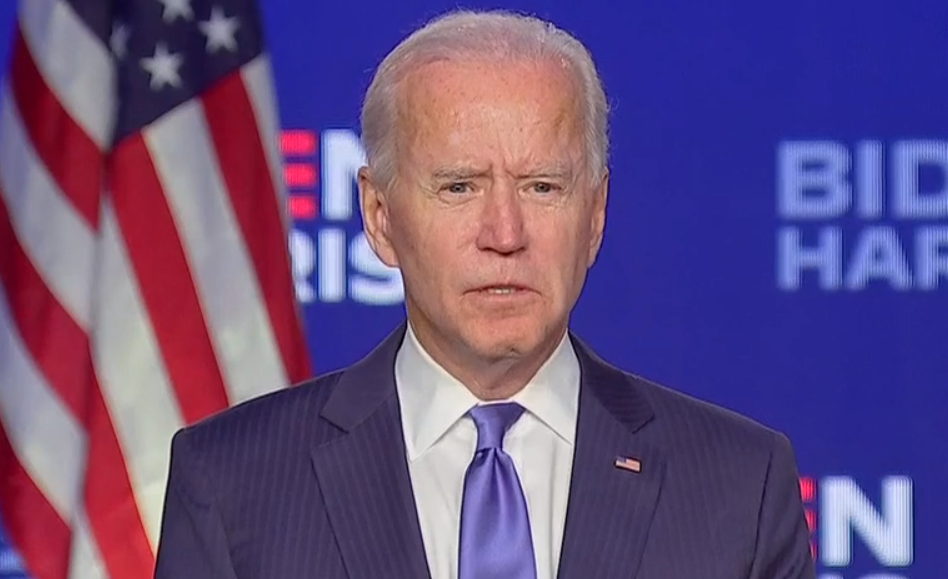

Republicans are pushing back harder on President Biden’s plan to wipe out billions of dollars in student loan debt.

The president signed an executive order last month dictating that $10,000 of debt be forgiven for those who took out student loans and are still laying them off. $20,00 if you took out a Pell Grant.

Republicans are questioning the legality and merits of Biden’s order.

“A student loan debt transfer does not cancel or forgive anything,” said Sen. Mike Braun (R-IN). “These debts will still be paid. It’s not like they go away. (Biden) has simply shifted the costs of repayment onto everyone, including the 65 percent of workers who chose not to get a college degree.”

Braun said on the Senate floor that the onus should be on pushing colleges to provide better value for the education they provide. He used Purdue University as an example with former university president Mitch Daniels freezing tuition for ten straight years without an increase.

Above all, however, Braun believes the president can’t unilaterally get rid of student loan debt.

“President Biden’s actions are illegal in the first place,” he said. “The president doesn’t have the authority to cancel all this debt.”

Braun is a co-signer of the Debt Cancellation Accountability Act, authored by Sen. Rick Scott (R-FL), which would mandate that the Dept. of Education get expressed permission from Congress to waive, reduce, or discharge any federal student loans.

2 comments

The federal student loan debt cancellation is largely the result of having a competent, policy-driven administration in office once again, and a strong, unified, relentless and widening grassroots movement to get federal student loan debt cancelled by a handful of organizations – In particular, the Student Debt Crisis Center, Student Borrower Protection Center, National Consumer Law Center’s Student Loan Borrower Assistance Project, Debt Collective, Student Loan Hero, Center for Responsible Lending, and Project on Student Loan Debt. These fairly new volunteer organizations have been unremitting in their coordinated persistence through letters, research, position papers, rallies, etc., in driving this singular issue in an environment focused on far more important domestic and world issues than this one with surprising success on all fronts.

The congress needs to do a comprehensive review of the Higher Education Act and update the sorely out of date Title IV programs. The last reauthorization of the Act was in 2008, and much has changed since then.

The entire federal student loan system is seriously out of date, having not been comprehensively reviewed, updated, and reauthorized by congress since 2008, and, consisting of multiple federal student loan programs and repayment options. So, it would be much better to comprehensively address the issue of student loan debt through federal Higher Education Act reauthorization, allowing for a thorough review and updating of the Act. The scheduled reauthorization is almost 3 cycles behind – 2013, 2028, 2023. This has never happened to this extent during the 57 years since the HEA was signed into law in 1965 on the campus of LBJ’s alma mater, Texas State University.

Ad hoc changes through the budget reconciliation process is not the way to make policy. The student loan program is broken and the accumulation of debt continues.

Over $40 billion in federal loan debt has accumulated since January 2021, while $35 billion has been cancelled through 3 existing programs (expanded and improved by the administration). So, comprehensive changes need to be made to the Title IV student financial aid programs that focus on college affordability and institutional and state accountability focused on limiting the accumulation of new student loan debt maintaining state appropriations for state programs.

That’s the congress’ job. Maybe with controlling Democratic majorities the Act can finally be comprehensively updated.

Firstly, I would argue that this administration is about as far from competent as it is possible to be. Second, I would point out that this isn’t a debt cancellation, it’s a transfer of the debt to people who didn’t incur it. Lastly, the reason education is so expensive isn’t because the Federal government hasn’t done anything, it’s expensive precisely because it HAS done something. Every time the Federal government interferes in a market, the costs go up. This has applies to every marketplace they have meddled in, be it education, healthcare, insurance, cars, or even the labor market.

Believing that the government has a role in funding higher education is flawed, but thinking their meddling will actually achieve that is nothing short of delusional.

If you REALLY want education costs to come down, eliminate the Federal loan and grant programs and make the SCHOOLS fund the grants and issue the loans. Anything short of that is just shoveling money into a pit of corruption.