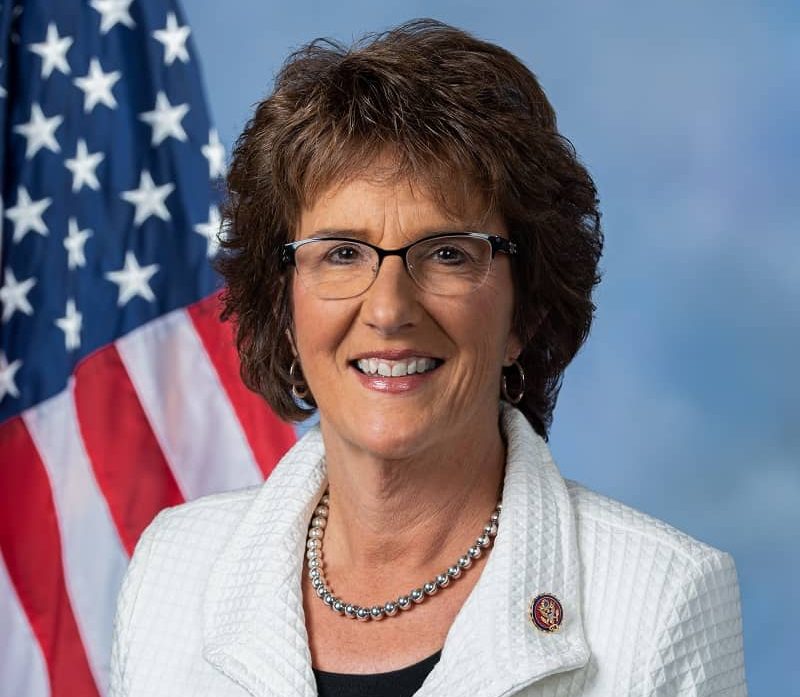

A proposal that’s part of Pres. Biden’s reconciliation package would require banks and financial institutions to report transactions over $600 to the IRS. Congresswoman Jackie Walorski (R-Ind.), said the proposal is an invasion of privacy and gives the government too much domain.

“This would turn financial institutions in my district into political outposts for the IRS with the sole purpose of reporting Hoosiers’ personal financial accounts to the agency,” said Walorski, in a video released on her Twitter feed Wednesday.

The purpose of the proposal is to collect unpaid tax money.

According to a report from the U.S. Treasury, collections are down from where they are supposed to be.

“The tax gap for business income (outside of large corporations) from the most recently published Internal Revenue Service (IRS) estimates is $166 billion a year,” reads the report.

“The scale of this revenue loss is driven primarily by the lack of comprehensive information reporting and the resulting difficulty identifying noncompliance outside of an audit. While the net misreporting percentage is only 5 percent for income subject to substantial information reporting, the net misreporting percentage for certain categories of business income exceeds 50 percent.”

LINK to the report: https://home.treasury.gov/system/files/131/General-Explanations-FY2022.pdf

Republicans are fighting back against the proposal with legislation to block it specifically, called the Banking Privacy Act of 2021.

“Aside from the obvious compliance issues for smaller financial institutions, this proposal raises serious privacy concerns, period,” said Walorski. “The IRS already’s been challenged by many thousands of leaks of documents on sensitive taxpayer information.”

Walorski said she believes were the Biden proposal to pass, the result would be exposure of Hoosier and American accountsto ill purposes.

“Let’s be clear. All taxes owed to the American government should be collected. But, we can do it in a way that protects the rights of taxpayers,” she said.

2 comments

So, she’s ok with the massive taxes on pork, beef, and milk? $500/$2500/$6500 annually per head, respectively.

She is ok with the massive tax hike on driving, and the privacy violations from that? $0.06/mile collected via Federal GPS. If your car gets 20MPG, that’s another $1.20/gallon in pure taxes!

She is ok with the driver facing camera and sensor requirements, shattering any notion of privacy in your car?

Was she ok with the government mandating that prescriptions will now be needed for vitamins? Raising the cost of a bottle of Flintstones to $73.50 doesn’t seem very friendly to working class parents.

She was certainly OK with the military red flag law, where the 2nd Amendment rights of veterans can be taken away without due process. She voted for it!

Don’t get me wrong, this IRS reporting scheme is horrible, but what about the rest of the horrible stuff the Dems have been pushing? Where’s Jackie?

What the hell!!!!! We pay taxes on our money when we cash and bank our checks every week and now the Demoncrats want to tax the crap out of our money a second time!!!!!! Looks like we the people need rise up because this is wrong.